Bonds are a popular investment option for many individuals and institutions looking to diversify their portfolios and generate steady income. In Canada, the bond market is an essential component of the financial system, providing issuers with capital and investors with an opportunity to earn returns through fixed interest payments. Trading bonds in Canada can be a lucrative endeavor, but it requires a good understanding of the market dynamics, investment strategies, and trading platforms available.

Overview of Bond Trading in Canada

Bond trading in Canada is primarily conducted on the Toronto Stock Exchange (TSX) and the Canadian Dealing Network (CDN). The Canadian bond market is diverse, with various types of bonds available for trading, including government bonds, corporate bonds, municipal bonds, and high-yield bonds. Government bonds, issued by the federal government or provincial governments, are considered safe investments as they are backed by the government’s creditworthiness. On the other hand, corporate bonds are issued by companies to raise capital, offering higher returns but higher risks compared to government bonds.

Key Strategies for Trading Canadian Bonds

When trading Canadian bonds, investors can employ a variety of strategies to maximize returns and manage risks. Some of the key strategies include:

1. Yield Curve Strategies: Investors can analyze the yield curve, which shows the relationship between bond yields and maturities, to identify opportunities for trading. For example, a steepening yield curve may indicate rising interest rates, leading investors to favor short-term bonds, while a flattening yield curve may signal economic uncertainty, prompting investors to focus on long-term bonds.

2. Credit Analysis: Before investing in corporate bonds, investors should conduct thorough credit analysis to assess the issuer’s financial health and creditworthiness. This analysis includes evaluating the company’s financial statements, credit ratings, and industry outlook to make informed investment decisions.

3. Duration Management: Duration measures a bond’s sensitivity to interest rate changes, with longer-duration bonds being more sensitive to interest rate fluctuations. Investors can manage their portfolio’s duration by diversifying across bonds with different maturities to mitigate interest rate risks.

Current Market Trends in Canadian Bond Trading

As of recent, the Canadian bond market has been impacted by various factors, including the COVID-19 pandemic, economic uncertainties, and changing monetary policies. The Bank of Canada has maintained low-interest rates to support the economy, leading to a surge in bond issuance and trading activity. Investors have sought safe-haven assets like government bonds amid market volatility, while corporate bond issuance has increased as companies look to raise capital in the low-interest rate environment.

Trading Tips and Techniques for Successful Bond Trading

To succeed in bond trading in Canada, investors should consider the following tips and techniques:

1. Stay Informed: Keep abreast of market developments, economic indicators, and central bank policies to make informed trading decisions and capitalize on market opportunities.

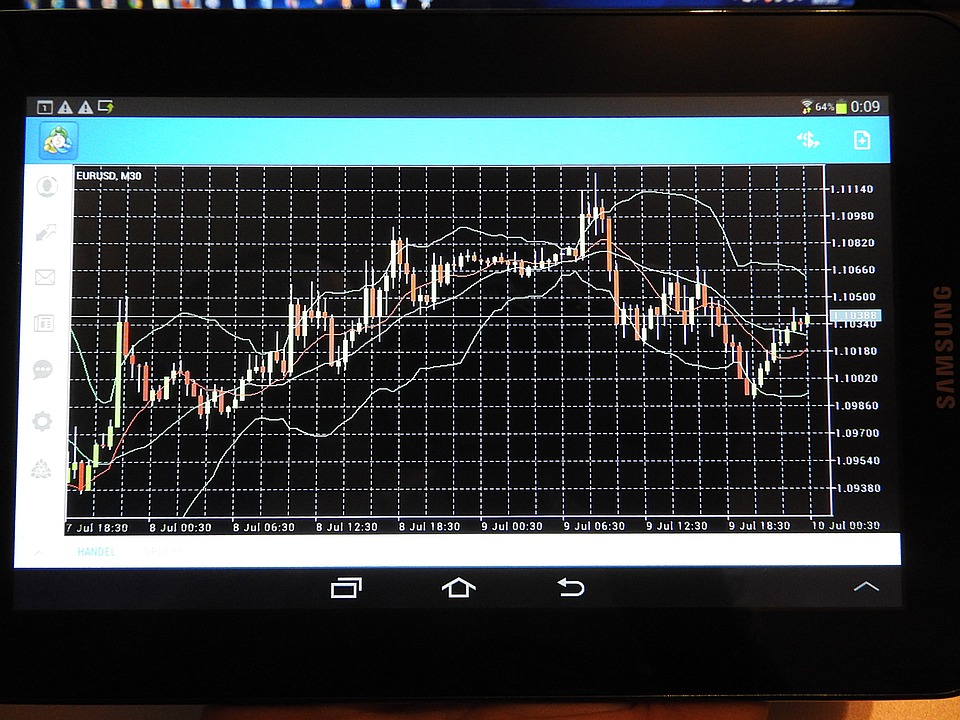

2. Use Trading Platforms: Utilize online trading platforms and brokerage services to access a wide range of bonds, research tools, and trading functionalities to execute trades efficiently.

3. Diversify Portfolio: Diversification is key to mitigating risks and optimizing returns in bond trading. Invest in a mix of government bonds, corporate bonds, and other fixed-income securities to achieve a balanced portfolio.

Performance Metrics, Market Analysis, and Opportunities in Canadian Bond Trading

Performance metrics like yield to maturity, duration, and credit spread can help investors evaluate the risk-return profile of bonds and compare different investment options. Market analysis, including technical analysis, fundamental analysis, and macroeconomic analysis, can provide insights into market trends, pricing dynamics, and investment opportunities in the Canadian bond market.

Overall, trading bonds in Canada offers investors a range of opportunities to diversify their portfolios and generate stable returns. By understanding the market dynamics, employing effective trading strategies, and staying informed about market trends, investors can navigate the complexities of bond trading and achieve their investment objectives. With the right knowledge and tools at their disposal, investors can capitalize on the opportunities within the Canadian bond market and build a successful bond trading strategy.